What to Know About State-Mandated Retirement Plans

A large portion of Americans will face a substantial retirement savings shortfall. Currently, 57 million employees do not have access to a retirement savings plan through their employer. Add to that, more than half of Americans have expressed concerns that they will not be able to afford retirement.

These trends present a critical problem in America, that, if not addressed will create an economic crisis for years to come. What’s the solution? Access and affordability have often stood in the way for small and medium-sized businesses to provide a payroll-deducted savings plan, sparking discussions – even action — at both the state and national level to help ensure employees have a way to save for their future.

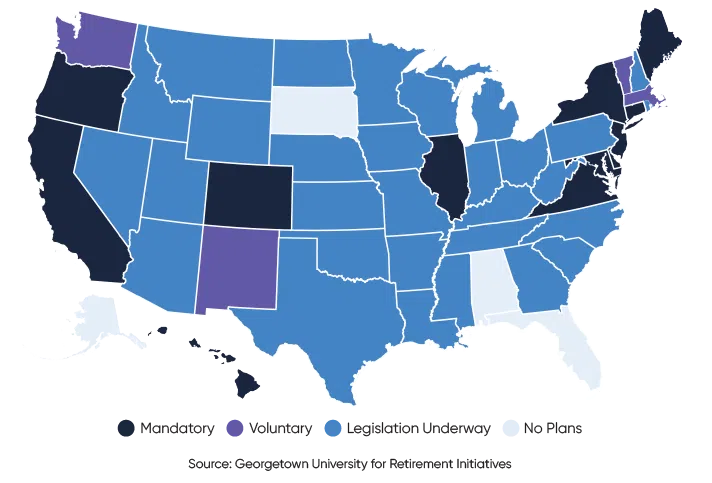

As a result, legislation requiring businesses to provide retirement benefits to their employees has passed in many states creating state-mandated, and in some cases, voluntary, retirement savings plans. This means employers have the added responsibility of selecting the best plan for their business and their employees, whether through the state, or other means, to help close the savings gap in America.

These trends present a critical problem in America, that, if not addressed will create an economic crisis for years to come. What’s the solution? Access and affordability have often stood in the way for small and medium-sized businesses to provide a payroll-deducted savings plan, sparking discussions – even action — at both the state and national level to help ensure employees have a way to save for their future.

As a result, legislation requiring businesses to provide retirement benefits to their employees has passed in many states creating state-mandated, and in some cases, voluntary, retirement savings plans. This means employers have the added responsibility of selecting the best plan for their business and their employees, whether through the state, or other means, to help close the savings gap in America.

States Enacting Retirement Plan Mandates.

State-mandated retirement plans are programs that require employers to offer a retirement savings solution to their employees. This can be done through a defined contribution plan such as an Individual Retirement Account (IRA) or a 401(k). Businesses of a certain size can enroll their employees in a state-sponsored retirement plan who would not otherwise have access to an employer-sponsored program.

IRAs are most common with state-mandated programs; however, the Multiple Employer 401(k) Plan (MEP) has been considered in a few states, providing a higher limit for employee contributions and option for employers to match those dollars. It is important to note, these state mandated retirement plans are intended for small and medium-sized businesses in the private sector and are entirely distinct from the state-sponsored retirement plans for government employees.

Read about the advantages of using Tilson's 401(k) provider.

What Do Employers Need to Know About State-Mandated Retirement Plans?

State-sponsored retirement plans have advantages and disadvantages that business owners must carefully consider. On the one hand, government-run programs are typically low-cost and have more fiduciary responsibilities for employers. On the other hand, these plans have rigid, one-size-fits-all designs and limited savings opportunities for employees.

If businesses do not comply, they may face significant financial penalties. Finally, whether employers participate in the state-sponsored plan or offer their own through the private market, it is essential to remember that an attractive employer sponsored retirement plan is sought after by prospective employees and can be a differentiating factor with both recruitment and retention.

What Are the Requirements for Employers?

The requirements for state-mandated retirement plans vary by state but is largely determined by the number of employees and the duration of the company’s operations. It’s important to note, however, that a mandate doesn’t mean a qualifying employer has to choose the state-directed option. Rather, they must prove they have a payroll deducted savings plan in place for their employees – through the state program or otherwise. Some businesses opt for a 401(k) — a multiple employer plan through a PEO like Tilson – which can provide a greater savings opportunity for the employee and more flexible plan options for the employer.

Employers who fail to register for their state-run plan or a qualifying private plan face hefty penalties of $250 per employee, increasing to $500 per employee for each following year if not compliant. Below is a list of states that have passed legislation, along with a few of their requirements.

State | Business Size | Deadline |

|---|---|---|

| California | 5+ Employees | June 2022 |

| Connecticut | 5+ Employees | October 2023 |

| Colorado | 5+ Employees | October 2022 |

| Delaware | 5+ Employees | 2025 |

| Hawaii | TBD | TBD |

| Illinois | 5+ Employees | November 2023 |

| Maryland | N/A | September 2022 |

| Maine | 25+ Employees | April 2023 |

| New Jersey | 25+ Employees | March 2022 |

| New York | 10+ Employees | Fall 2022 / TBD |

| Oregon | 4 or Fewer Employees | March 2023 |

| Virginia | 25+ Employees | July 2023 |

| Seattle, Washington | N/A | Summer 2023 |

What’s the Difference Between a 401(k) and State IRA Plans?

A key advantage to choosing a 401(k) is that employers can easily and cost-effectively participate in the larger multiple employer 401(k) plan (MEP) or pooled employer 401(k) plan (PEP). These pooled plan products nearly eliminate the administrative burden and fiduciary risk that comes with a single employer 401(k) plan.

On average, pooled 401(k) plans are about half the cost of a single employer plan. Further, these plans are flexible; employers can create a plan that works for them instead of the one-size-fits-all rigidity of state-sponsored plans. Below are a few options on how a plan can be customized:

- Eligibility Requirements

- Auto Enrollment

- Deferral Changes

- Loan Repayments

- Safe Harbor

- Discretionary Matching

- Profit Sharing

- Vesting Schedules

While IRA and 401(k) retirement accounts are similar in structure, there are some key differences that businesses should note to make the right choice when deciding between a state-sponsored IRA plan or a 401(k). The chart below illustrates some of the differences between the two – the largest being the maximum dollar amount a participant and employer would be able to contribute to in an employee’s account during the tax year.

Why Small and Medium Sized Businesses Should Offer a 401(k) Plan

If you own a small or medium-sized business and want (or need) to provide a retirement plan for your employees, a state-mandated plan is an option. However, a 401(k) may be a better fit with added flexibility and customized plan options for your business and a greater savings opportunity for your employees.

A 401(k) is an excellent benefit for any employer to offer their employees, especially those of you who are running a small or medium-sized business. It’s financially advantageous because tax credits are available, and if done correctly can also be an attractive recruitment tool for top talent.

IRA vs. 401(k) Contributions

| IRA | 401(k) | |

|---|---|---|

| Participant Contributions | $6,000 under age 50 / $7,000 age 50 and older | $20,500 under age 50 / $27,500 age 50 and older |

| Employer Contributions | Employer MAY NOT contribute to participants’ IRA | Employer MAY match a portion of participant contributions and offer profit sharing |

Talk to Tilson today.