So you might be asking, “What is a PEO?”

Simply put, Professional Employer Organizations (PEOs) are growth accelerators for small to mid-sized businesses. That’s because, as a PEO, we tackle the complicated tasks of benefits, payroll, compliance and other HR functions so that business leaders like you can focus on the ideas that drive growth and success. Studies show businesses that work with an Indiana PEO company grows faster, have lower employee turnover and are less likely to fail.

What is co-employment?

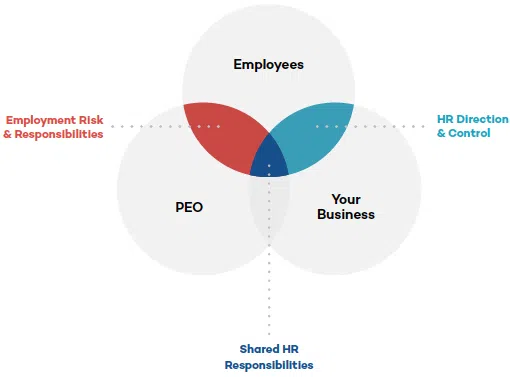

As a PEO (professional employer organization), Tilson is able to act as a full service human resources department – administering payroll and benefits, ensuring compliance with federal and state regulations and controlling costs by using large group pooling strategies – through a co-employment relationship.

In this type of shared relationship, Tilson handles many specific employer-related, responsibilities and risks in order to effectively manage your company’s critical HR functions, all while you maintain control of your workforce and operations so that you can focus on the ideas that drive growth and success.

PEOs: the must-have hack for SMBs

What's a Professional Employer Organization (PEO)?

A PEO is a company that provides human resources services to other businesses. These services include payroll processing, benefits administration, HR support and compliance management.

How Does a PEO Work?

When a company partners with a PEO, the PEO becomes the employer of record for the company’s employees. This means that the PEO handles the administrative tasks related to employment, while the company maintains control over the day-to-day activities of its employees.

What Are the Benefits of Using a PEO?

Access to Better Employee Benefits: PEOs often have the ability to negotiate better rates on employee benefits like health insurance, retirement plans, and other perks that may not be available to small businesses on their own.

Reduced Administrative Burden: PEOs can handle many of the administrative tasks related to employment, such as payroll processing, tax compliance, and employment law compliance. This frees up business owners and their staff to focus on other aspects of their business.

Improved Compliance: PEOs stay up-to-date on employment laws and regulations, ensuring that their clients remain compliant with the latest regulations. This can help reduce the risk of legal issues and financial penalties.

Expert HR Guidance: PEOs often have a team of HR professionals who can provide expert guidance on a range of HR issues, from employee relations to performance management.

Cost Savings: By outsourcing HR functions to a PEO, businesses can often save money on employee benefits, payroll processing, and other HR-related costs. Additionally, PEOs can help reduce the risk of costly legal issues and fines.

How does a PEO handle payroll processing?

PEOs typically use their own payroll system to process payroll for their clients’ employees. This includes calculating employee wages, withholding taxes, and making sure that all payroll-related regulations are followed.

Can a PEO help with employee benefits administration?

Yes, PEOs can help with employee benefits administration. PEOs offer comprehensive benefits packages, including health insurance, retirement plans, and employee assistance programs. The PEO also handles the administration of these benefits, including enrollment, and compliance with applicable laws and regulations. By partnering with a PEO, small and mid-sized businesses can gain access to high-quality benefits that are typically only available to larger organizations, while also relieving the administrative burden of managing these programs in-house.

Is using a PEO a good option for all businesses?

Using a PEO can be a good option for many businesses, but it may not be the best fit for all companies. PEOs are generally a good fit for small to mid-sized businesses that want to offer competitive benefits packages, reduce HR administrative burdens, and ensure compliance with employment laws and regulations. However, larger organizations may find that they have the resources to manage these functions in-house and may not need the additional support of a PEO. Ultimately, the decision to use a PEO depends on the unique needs and goals of each business, and it’s important to carefully evaluate the benefits and costs of partnering with a PEO before making a decision.

How can a company choose the right PEO?

When selecting a PEO, it’s important to consider factors such as the company’s experience and reputation, the types of services offered, and the pricing structure. Additionally, it’s important to make sure that the PEO can meet the specific needs of the company and its employees.

How our services make you a high performance company.

HR Insights, Keeping You Informed.

Talk to Tilson today.